№8705[Quote]

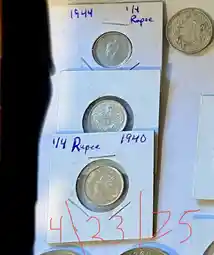

File: IMG_1570.jpeg 📥︎ (2.12 MB, 2356x1359) 49363a9f34aa61b948578fe6c8bb8e55f3a9620e233d13cf8fc04da6564e301b0ImgOps

because I prefer wealth to poverty

№8710[Quote]

>>8705That's not your gold you are jeet silver scammer. We all know how stackturds behave try to fit in stinky

№8713[Quote]

SILVER IS ROCKETING TO OVER $3.50

№8718[Quote]

>$33.50

№8743[Quote]

File: IMG_6519.jpeg 📥︎ (2.51 MB, 4032x3024) 4399645e3a6c8ce6d772730fa9960df27e31e6118558d28d3a743976558ae6890ImgOps

>>8710kek!

>vpn nigger = nigger jeetdalit claws type pablum, nonsensical doublespeak and fool shilling unceasingly!

greasy jeet poos oily stools in the street!

№8745[Quote]

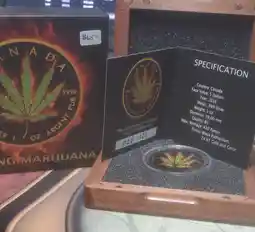

>>8738numi anon, how much are these coins? is the pricing and availability near unobtanium?

i have not seen theses outside of /pmg/ and chudbiz

№8756[Quote]

Just sold $300,000 of etfs into the rally, $27,000 profit in a few weeks thanks Trump!. Lmao have stackturds ever made a profit? Nope. Everytime they buy and sell they lose 5%-88% lmao nothing dumber or poorer than a stacktard

№8759[Quote]

Nothing dumber or poorer than a stacktard

№8763[Quote]

>>8743Lmao look at the stinkjeet posting his entire dalit castes life savings can't even afford a toilet for his village. Remember goy anyone who posts metal is a stinkjeet

№8772[Quote]

Silver baggies are low IQ peasants

№8799[Quote]

>>8788>st helena guineanice, i want one of those

№8808[Quote]

>>8745most are pretty reasonable, say up to a couple hundred for the 5 mark coins. the 5 mark in the pic is one of the cheaper 5 marks and has a mintage of 50k. i usually find them here:

https://www.ma-shops.com/germany-since-1871/?submitBtn=Search №8844[Quote]

Gold has been getting ass raped the last 32 hours!

№8867[Quote]

>Condensed Grok research on gold silver rarity per capita

This conversation focused on estimating the above-ground stocks of gold and silver, with a particular emphasis on the *liquid* (quickly available) portions for investment or ETF exposure in a financial emergency. Initial estimates for total above-ground stocks were ~6.95 billion troy ounces (~216,000 metric tons) for gold and ~45–50 billion troy ounces (~1.4–1.55 million metric tons) for silver. However, concerns about silver’s industrial use (e.g., solar, electronics) and losses led to a revised silver estimate of ~28.6 billion troy ounces (~889,000 metric tons), as much is unrecoverable or hard to refine quickly. For both metals, only a small fraction of total stocks—investment-grade bullion (coins, bars, ETFs, and vaulted inventories)—is liquid in a crisis, as jewelry, industrial uses, and central bank reserves (for gold) are largely inaccessible within weeks to months.

After refining estimates, the liquid stocks were calculated as ~340–580 million troy ounces (~10,565–18,040 metric tons) for gold (midpoint: ~460 million ounces) and ~1.5–2 billion troy ounces (~46,650–62,200 metric tons) for silver (midpoint: ~1.75 billion ounces). Gold’s liquid stock includes ~100–160 million ounces in coins and ~200–360 million in bars, while silver’s includes ~0.3–0.4 billion ounces in coins and ~0.8–1.2 billion in bars. These figures reflect ETF/vaulted stocks, dealer inventories, and a liquid portion of private holdings, as jewelry and industrial silver are too slow to mobilize. Dividing by the global population (~8.1 billion), the per capita liquid stock is ~0.057 troy ounces for gold (~1.77 grams, ~$150–$200 at $2,700/oz) and ~0.216 troy ounces for silver (~6.72 grams, ~$7–$10 at $35/oz). These tiny amounts highlight the scarcity of accessible precious metals, especially gold, with silver’s higher availability tempered by its lower value and uneven distribution.

№8873[Quote]

>>8844I'm in silver, not gold, but I don't understand the gold dump. My understanding is that it was pumping because the big boys were buying. So now let's say the big boys stopped buying, wouldn't the price just crab instead of dump? I don't understand why the big boys are selling.

№8875[Quote]

To estimate the per capita availability of quickly available (liquid) gold and silver stocks, we’ll use the liquid stock estimates from the previous response and divide them by the global population. The liquid stocks represent the investment-grade bullion (coins, bars, ETFs, and vaulted inventories) that could be accessed in a financial emergency for purchase or ETF exposure. We’ll calculate the per capita availability in troy ounces for both metals, providing a clear picture of how much liquid gold and silver is theoretically available per person globally.

### Key Inputs

1. Liquid Stock Estimates:

- Gold: ~340–580 million troy ounces (midpoint: ~460 million ounces).

- Coins: ~100–160 million ounces (midpoint: ~130 million ounces).

- Bars: ~200–360 million ounces (midpoint: ~280 million ounces).

- Silver: ~1.5–2 billion troy ounces (midpoint: ~1.75 billion ounces).

- Coins: ~0.3–0.4 billion ounces (midpoint: ~0.35 billion ounces).

- Bars: ~0.8–1.2 billion ounces (midpoint: ~1 billion ounces).

- These figures include ETF/vaulted stocks, dealer inventories, and a liquid portion of private holdings, as they’re the most accessible in a crisis.

2. Global Population:

- As of April 22, 2025, the global population is approximately 8.1 billion people, based on UN and World Bank estimates (reaching 8 billion in November 2022 and growing at ~0.8% annually).

3. Calculation Method:

- Per capita availability = Liquid stock (troy ounces) ÷ Global population.

- We’ll compute for total liquid stock, coins, and bars separately, using the range (low–high) and midpoint for accuracy.

### Per Capita Calculations

#### Gold

- Total Liquid Gold Stock: ~340–580 million troy ounces (midpoint: 460 million).

- Low Estimate: 340,000,000 ÷ 8,100,000,000 = ~0.042 troy ounces per capita.

- High Estimate: 580,000,000 ÷ 8,100,000,000 = ~0.072 troy ounces per capita.

- Midpoint: 460,000,000 ÷ 8,100,000,000 = ~0.057 troy ounces per capita.

- Coins: ~100–160 million troy ounces (midpoint: 130 million).

- Low: 100,000,000 ÷ 8,100,000,000 = ~0.012 troy ounces per capita.

- High: 160,000,000 ÷ 8,100,000,000 = ~0.020 troy ounces per capita.

- Midpoint: 130,000,000 ÷ 8,100,000,000 = ~0.016 troy ounces per capita.

- Bars: ~200–360 million troy ounces (midpoint: 280 million).

- Low: 200,000,000 ÷ 8,100,000,000 = ~0.025 troy ounces per capita.

- High: 360,000,000 ÷ 8,100,000,000 = ~0.044 troy ounces per capita.

- Midpoint: 280,000,000 ÷ 8,100,000,000 = ~0.035 troy ounces per capita.

#### Silver

- Total Liquid Silver Stock: ~1.5–2 billion troy ounces (midpoint: 1.75 billion).

- Low Estimate: 1,500,000,000 ÷ 8,100,000,000 = ~0.185 troy ounces per capita.

- High Estimate: 2,000,000,000 ÷ 8,100,000,000 = ~0.247 troy ounces per capita.

- Midpoint: 1,750,000,000 ÷ 8,100,000,000 = ~0.216 troy ounces per capita.

- Coins: ~0.3–0.4 billion troy ounces (midpoint: 0.35 billion).

- Low: 300,000,000 ÷ 8,100,000,000 = ~0.037 troy ounces per capita.

- High: 400,000,000 ÷ 8,100,000,000 = ~0.049 troy ounces per capita.

- Midpoint: 350,000,000 ÷ 8,100,000,000 = ~0.043 troy ounces per capita.

- Bars: ~0.8–1.2 billion troy ounces (midpoint: 1 billion).

- Low: 800,000,000 ÷ 8,100,000,000 = ~0.099 troy ounces per capita.

- High: 1,200,000,000 ÷ 8,100,000,000 = ~0.148 troy ounces per capita.

- Midpoint: 1,000,000,000 ÷ 8,100,000,000 = ~0.123 troy ounces per capita.

### Summary Table

| Metal | Category | Liquid Stock (Million Troy Ounces) | Per Capita (Troy Ounces, Low) | Per Capita (Troy Ounces, High) | Per Capita (Troy Ounces, Midpoint) |

|--|--|-------|-----–|------|--------|

| Gold | Total | 340–580 | 0.042 | 0.072 | 0.057 |

| | Coins | 100–160 | 0.012 | 0.020 | 0.016 |

| | Bars | 200–360 | 0.025 | 0.044 | 0.035 |

| Silver | Total | 1,500–2,000 | 0.185 | 0.247 | 0.216 |

| | Coins | 300–400 | 0.037 | 0.049 | 0.043 |

| | Bars | 800–1,200 | 0.099 | 0.148 | 0.123 |

### Interpretation

- Gold Per Capita:

- Total: ~0.057 ounces/person (midpoint). This is equivalent to ~1.77 grams (1 troy ounce = 31.1035 grams), or roughly $150–$200 at current gold prices (~$2,700/oz in April 2025). This tiny amount reflects gold’s scarcity and high value, meaning even liquid stocks are spread thinly across the population.

- Coins: ~0.016 ounces/person (~0.5 grams). Enough for a small fraction of a 1-oz coin (e.g., a quarter of a Gold Eagle).

- Bars: ~0.035 ounces/person (~1.1 grams). More available than coins due to vaulted/ETF dominance.

- Silver Per Capita:

- Total: ~0.216 ounces/person (midpoint). This is ~6.72 grams, or ~$7–$10 at current silver prices (~$35/oz). Silver’s higher availability reflects its greater mined volume but lower value.

- Coins: ~0.043 ounces/person (~1.34 grams). Enough for a small fraction of a 1-oz coin (e.g., a tenth of a Silver Eagle).

- Bars: ~0.123 ounces/person (~3.82 grams). More available than coins due to institutional/vaulted holdings.

- Gold vs. Silver:

- Silver’s per capita availability (~0.216 oz) is ~3.8 times higher than gold’s (~0.057 oz), reflecting silver’s larger liquid stock (~1.75 billion vs. ~460 million ounces). However, gold’s higher price makes its per capita value ~20–30 times greater than silver’s.

- The gold-to-silver ratio in liquid stocks (~1:3.8) is lower than the total stock ratio (~1:7–9), as silver’s industrial use reduces its liquid share.

### Context and Caveats

- Uneven Distribution: Liquid gold and silver are not evenly distributed. Most are held in developed nations (e.g., U.S., Europe) or by wealthy investors, so per capita figures overstate availability for most people. For example, COMEX/LBMA vaults and ETFs are concentrated in the U.S. and UK.

- Crisis Dynamics: In a financial emergency, hoarding or price spikes could reduce the liquid supply further. Not all private holders will sell, and ETF/vaulted stocks (~150–200 million oz for gold, ~0.8 billion oz for silver) may face delivery constraints.

- ETF Exposure: ETFs hold only ~40–50 million ounces of gold and ~0.5–0.8 billion ounces of silver. Per capita ETF exposure is even lower (gold: ~0.006 oz/person; silver: ~0.086 oz/person), highlighting limited capacity for mass investment.

- Recycling: Gold’s high recyclability (~90%) could add small amounts from jewelry (~10–20 million oz/year), but silver’s low recycling rate (~20%) limits quick additions. These are excluded from liquid estimates due to time constraints.

### Supporting Evidence

- World Gold Council (2024): Confirms ~40–50 million ounces in gold ETFs and ~2 billion in bullion, supporting the ~340–580 million ounce liquid estimate.

- Silver Institute (2024): Notes ~0.5–0.8 billion ounces in silver ETFs and ~4 billion in bullion, aligning with the ~1.5–2 billion ounce liquid estimate.

- X Posts: Highlight tight vaulted stocks (e.g., COMEX gold ~120 million oz, silver ~300–500 million oz) and limited retail availability during demand spikes.

- Population Data: UN/World Bank estimate ~8.1 billion people in 2025, consistent with growth trends.

### Final Thoughts

The per capita liquid stock for gold (~0.057 oz/person) and silver (~0.216 oz/person) underscores their scarcity, especially for gold, which equates to just ~1.77 grams per person globally. Silver’s higher per capita availability (~6.72 grams) reflects its larger liquid stock, but both metals are tightly held by institutions, ETFs, and wealthy investors, limiting real-world access. In a crisis, these figures would feel even smaller due to hoarding or supply chain issues. If you want to explore regional disparities, ETF mechanics, or convert these to value terms (e.g., dollars per capita), let me know!

№8970[Quote]

>>8875Ran this thru various AI models, gold is worth $2265 silver $18

№8976[Quote]

>>8873>I'm in silver, not gold, but I don't understand the gold dump. MyYeah well you start out admitting ur a dumbass than say you don't know the unknowable….lmao. Nothing dumber than a stacktard

№8991[Quote]

>>8970lol, wtf are you talking about

№8995[Quote]

>>8868I wouldn't get too excited until we pass 36.

№8997[Quote]

>>8991He's the village idiot, just ignore him.

№9004[Quote]

>>8997Found the jealous stackturd

№9050[Quote]

>>9004Any stacktards ever make a profit? Lmao, of course not

№9084[Quote]

>>8873gold is a safe haven for rocky stonks and bonds and crypto. crypto and stock market pumping, so gold will drop some. it will go back up. its a slow thing. these huge $100 swings is not indicative of normal metal trends

№9091[Quote]

>>8970that doesnt seem accurate

№9167[Quote]

>>9091Like I said, village idiot.

№9206[Quote]

Is silver having a short squeeze right now? Makes no sense to pump while gold crabs.

№9232[Quote]

>>9206Everything else including copper and oil was up today. Made no sense for silver to crab the last 12 months while gold mooned.

№9286[Quote]

>>9206considering gold just shot up like $250 bucks and then back down $150 its still on average slowly ticking upwards. so if anything the GSR is coming back in within its own 10year margins

>if you believe in GSR №9287[Quote]

File: snow bistre.png 📥︎ (634.39 KB, 1218x1569) e92e504f16ff74372b269b6112fac4950d25a2c4435aec9efe0627e5101e8bf90ImgOps

>>9271>40oz of silververy nice

№9356[Quote]

>>8873> I don't understand the gold dump.Central bank buying .. could even be China . Buying in big dollops that’s why US$ dropped so much. When they pause big correction. Just temporarily classic oversold us$. The bull has just started

№9358[Quote]

> I personally posess 40 ounces of silver

Based fren

№9362[Quote]

>>8710> We all know how stackturds behave try to fit in stinky> cringe max contra indicatorYou know your early in the bull market when still so much seething hate around PMs.

№9368[Quote]

>>9362It's just cowboys and indians. The vpnigger himself was telling others to buy gold in a /pol/ thread.

№9370[Quote]

>>9362You don't own pm stinkjeet

№9373[Quote]

>>9357>Jp Morgan is tamping prices down>I believe jp Morgan price targetsLmao nothing dumber than a stacktard

№9375[Quote]

>>9356Financial incel is an expert at everything, still a brokie

№9396[Quote]

>>9357$4000 EOY is what ive been hearing from alot of folks who are leaning heavy into gold. i know an attorney who bought alot of gold at once (like, 250K from a settlement he won). but he put it in the hands of the swiss, which to me is crazy so it might as well be an ETF

on that note, has anyone checked the price of CHF recently? i thought about getting some but i tend to stay away from forex market

№9420[Quote]

File: IMG_2078.jpeg 📥︎ (262.76 KB, 929x1200) f1a5e9e0095b6906dde46d3c760592e66370dc4f8b0e41f9daaf4e1e879297800ImgOps

>>9271>Hello /pmg/>I am just letting you know I personally posess 40 ounces of silverBased

№9432[Quote]

>>9286I believe in GSR, in fact I believe when gold hits 10,000 USD the GSR will be around 20.

№9505[Quote]

>>9474thx chud. I got the RC (assuming) but the scripty Dz is unknown to me. I will add it to the stack of sterlingish stuff I have been acoomulating

№9523[Quote]

Nothing dumber or broker than a stacktard

№9546[Quote]

File: freeza.png 📥︎ (116.88 KB, 404x462) 4e66da6c330dda19b348fcc384c275a14139c738612d9eff32ac997bd29267380ImgOps

>>9474thats pretty cool info; didnt know about loth purity. i learned something today….thanks :)

№9553[Quote]

File: IMG_7328.jpeg 📥︎ (155.32 KB, 657x784) 773a9772599ac1e44733dbaaee77cae209d226083c5ea1e2459903c3b695e07c0ImgOps

there are many subhumans muh more simple minded than stackchads:

silber hating jeets

golb hating jeets

zero satoshi owning jeets

streetpooing dalits

power bottom benchods

cow dung buyers (stackturds)

false millionaires that stack $1.53 in foreign currency

monke that never stops dancin’

>these 4 coins (fractions of silver rupee) are more than this lunatic, dalit will ever acquire in its lifetime of samefagging and shilling nonsense

(you)

№9580[Quote]

>>9271LETS GOOOOOOOOOOOOOOOOOOOOOOOOO

№9634[Quote]

File: bbbros.JPG 📥︎ (3.79 KB, 56x73) 7f01924cd8599e6c6de499e4a1357b23a793e1da90b98dac52e09da83f43e2170ImgOps

when is silver going to go up

№9642[Quote]

>>9634By the end of the year. A lot of rivers lead to the ocean that is silver suppression. A lot of it has to do with reckless QE up to two years ago now affecting money markets, but there are many telltale signs. The inverted 10YY, the dollar being devalued, the yuan and yen being obliterated, the Silver Institute this year changing historical data to skew false current market demand, hook nosed grabbler shills going on TV in droves saying to just buy gold and silver ETFs en masse this year, costco selling gold, mannarino has a beard now. But most importantly the most obvious clue is vpn users claiming silver is a scam and woefully wishing that people don't stack it. Biggest buy warning. A lot of indicators lead to silver breakout. You have to be aware that the GSR is 100 right now which is pretty funny. JP Morgan is just a Chinese front, and all countries with a central bank or marching to the beat of the same drums. They will cause the world economy to collapse, cause a world war and then create a cbdc to replace it all. But in order to do that they will revalue gold which central banks have been hoarding now more than ever. Silver is essentially going to go parabolic, without a doubt beyond even silver bulls' expectations.

№9665[Quote]

>>9624Lucky! How much do those go for by you?

№9677[Quote]

>>9665Pretty much spot, those are common date and were minted in large quantity. Even if they are 150yo they still don't carry any premium over spot usually. Still that's a $85 gift in silber, can't complain. :3

It's the first time i get a gift (if it wasn't a mistake, but it seems pretty big for a mistake) from an ebayer, and i made hundreds of silver purchases there.

Looking at his account, he was a pretty decent sized seller, and it was his very last item on sale, now his shop is empty, maybe it was a farewell move?

№9838[Quote]

File: dimes.jpeg 📥︎ (374.6 KB, 1024x1536) 7f4373c29da4a077248d9e98815a6b344fdcfda8a4d57686d24d00454bb17ed90ImgOps

№9881[Quote]

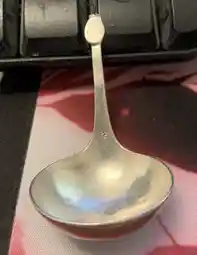

File: IMG_4319.jpg 📥︎ (1.27 MB, 1794x2325) 161965965b4c8296683c625a83354446c672f72bfe66e66227e37e45b80e9ddd0ImgOps

got another unknown item, the S is the only mark on the thing, the original handle was busted off and a new one was soldered on (and subsequently broken off) I'm thinking this one is also silver (perhaps coin)

№9948[Quote]

>>9881More brass spoons Bob?

№9949[Quote]

>>9642>>9642By the end of the year. A lot of rivers of stackturd tears lead to the ocean that is crying about imaginary silver suppression. A

№9973[Quote]

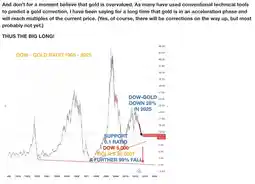

File: IMG_1603.jpeg 📥︎ (638.18 KB, 1710x979) 977cbc8716f472961d16515035561410ebfa0405eaaf4968eaab5968ebafcaad0ImgOps

Confirmed central banks buying in big dollops ..

e.g Azerbaijan state oil fund just announced added 25MT of gold to holdings in Q1 25 (that’s 804 million ozs)

Wait until wall st / retail / generalist decides they need 5-20% in gold ..BOOM!

№9992[Quote]

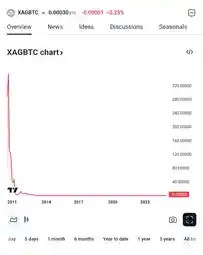

File: IMG_1604.jpeg 📥︎ (548.04 KB, 1535x1107) 0cc7372519924ec8326c4d93e464304d6c9bf92f2e1f6cc79b0f8b3370ecfb880ImgOps

Here is why gold is not even close to overvalued .Long term going at least 1 to 1 priced in Dow jones ..Probably $20K gold $20k Dow..but could go even to $50K pic related .

Anyone not owning some gold will lose significant wealth

№10010[Quote]

File: Pity.jpg 📥︎ (76.54 KB, 800x1006) be85554aaac5512aa155ebf0517aab55552aaa55550aaa85050fdfa2aff4557a0ImgOps

Here is why gold is not even close to overvalued .Long term going at least 1 to 1 priced in Dogecoins ..Probably $2 gold $2 dogecoin..but could go even to $1 pic related .

Anyone owning some gold will lose significant wealth

№10015[Quote]

>>8698 (OP)thx 4 the bake OP

GOLDSISTERS WE ARE SO BACK!!!

№10018[Quote]

>>10016i do like me some sovereigns; but 20 franc coins are pretty damn comfy too.

№10204[Quote]

>>10171I wish Costco had a bigger selection they should they should just become a coin shop

№10261[Quote]

>>10253is that john's daughter?

№10271[Quote]

>>10261Hey goys you didn't get scammed by Jews on ur silver because the Jews are suppressing the price. Lmao yeah that's it

№10279[Quote]

File: HB.png 📥︎ (3.18 MB, 1024x1536) c666e64c0ce5770c1ccdf8c3f94c98ec4f70893c4334630c230d71f1f8f796d30ImgOps

>>9838I posted this ghibli render on R:SilverDegenerates and it got a bunch of down votes and comments from redditors like "those girls look young", "is this pedo raisin?". And then they banned me altogether, lmao!

№10296[Quote]

>>10279Wtf? Redditors are truly deranged. I miss 4chan. If you haven't checked in a while, they updated the site with a message saying they're coming back soon.

>>10015I want gold, but I can't justify it when silver is this cheap. Considering putting some dosh into miner ETFs though. Anyone have any experience with that?

№10374[Quote]

File: the don.jpg 📥︎ (497.18 KB, 1574x823) 786f9c69987b944984cf96a5c6ad52a75706689779198956fe6e867c82394ce00ImgOps

№10377[Quote]

>>10279Imaginary pedo shaming is the social virtue signaling of nu-cuckservatives, just like protecting imaginary oppressed trannies & niggers is the signaling of leftards. In the end they all want online good goy points.

№10432[Quote]

>>10377Incels are stuck looking at this tranime garbage because they don't have real relationships and due to their stunted social development stuck at underage girls. Lmao jews claim they can cure incrlism if you buy garbage rocks>>>>>>>>arrested development

№10436[Quote]

>>10374Buy Todd's garbage, support an anti white drug pusher, 100% premium take insta 50% loss

№10573[Quote]

File: cannabro.png 📥︎ (3.32 MB, 1451x1321) fde6c0f54f569c290df4de318aec0f867070f3c6440c79f31606e9f4872018fb0ImgOps

№10616[Quote]

>>10573probably a canadian guy complaining about canadian coins hey

№10655[Quote]

>>10204them and walmart even do drop ship with their online store for others like apmex i believe

№10704[Quote]

>>10573Look it's Todd the anti white drug pusher shilling his poisons

№10724[Quote]

File: omfg.jpg 📥︎ (8.18 KB, 197x200) 55b9d8cee28c6b4b39c5aa75ec668178159ac4c24af1f80c6f8cce073a913e3d0ImgOps

with gold and silver pumping, i think ill buy another oz of platinum to stack. im almost at 20oz…then i swear ill stop

№10747[Quote]

Stackturds are so far behind its mathematically impossible to catch up

№10764[Quote]

>>10724Bro stop… you have a problem.

№10775[Quote]

>>8698 (OP)precious metals are such a dograisin investment this general should be moved from /biz/ to /x/

№10791[Quote]

ohhh cool; they make platinum coins in 1/3troy ounces

https://www.ebay.com/itm/176980539809kinda neat. i dont have any coins in this weight yet. and the price aint bad neither

№10854[Quote]

>>10849can you make explosives with it?

I heard it smells funny

№10876[Quote]

>>10854>>10856>>10860>it explodes with enough force to shatter glass when boiled in an exotic acidwow that sure is one of the most retardedly impractical explosives on earth

№10890[Quote]

File: bbbros.JPG 📥︎ (3.79 KB, 56x73) 7f01924cd8599e6c6de499e4a1357b23a793e1da90b98dac52e09da83f43e2170ImgOps

when is silver going to go up

№10955[Quote]

>>10854you put it in shotgun shells and hunt birds with it where lead is banned; plus its not toxic like lead so better for eating i guess

№10958[Quote]

>>10890its been up; i bought most of mine when it was $14-17

№11064[Quote]

I'm planning to buy gold directly from miner since there's many illegal mine in this 3rd world raisinhole

what's the best way to test for purity while being mobile and fast?

№11080[Quote]

Sure you did jeet

№11081[Quote]

10 years of pmg and stacktards are still broke depressed incel losers

№11090[Quote]

this is a good video for those who got nervous when gold went down a bit and also for silver fags bitching about silver crabbing

https://www.youtube.com/watch?v=a550YLJwxLA №11098[Quote]

Roundhouse kick a nigger off a skyscaper.

№11269[Quote]

>>11064I don't think it's that simple anon. If you come with a testing kit to an illegal mine they will immediately figure out you are a clown and rob your ass and leave you half dead in a ditch.

№11298[Quote]

>>11090Just watch this Jew propaganda goy. Lmao stacktards love being told what to do by their masters>>>>broke depressed incel losers

№11323[Quote]

>>11090I don't trust women with financial advice.

№11409[Quote]

>>11323she's just a cute broad reading what a man wrote for her, newfag. relax a little

№11412[Quote]

>>10876well you'll have to explain that to the DEI customs inspector if you go there to pick it up.

№11438[Quote]

>>11409I'll just stick to moneco64. Old white dudes are the only people I trust for PM news and info.

№11446[Quote]

>>11412here in America we are allowed to legally produce and immediately use up to 50 lbs of explosives

it got hit with tariffs and chinx who sent it to me don't want to pay the import fee, and amazon doesn't know what to do about it

OR "THEY" suppress bismuth metal - universally rarer than gold, and uniquely beautiful, but criminally undervalued

№11501[Quote]

>>11446well at least now you can pay for the tariff, buy some perchloric acid and go full Mc Veigh on them as revenge.

№11551[Quote]

okay niggers

i'm bored

start posting

№11566[Quote]

>>11283based and exitbag pilled

№11570[Quote]

>>11551…so I met these jews that buy fucked up coins (99.9% pure) like scratched coins, coins that have been tested for purity, etc. and they also buy sterling silver and purify it. they make bars of 250g 500g and 1kg and sell it at 5% under spot. they got a licence issued by the government to do this and have an established bussiness, like a shop (they also sell coins) should I buy some of these cast bars? how difficult will it be to sell them if I have to?

they also will buy broken jewelry, silverware or fucked up coins @ 30% under spot.

№11576[Quote]

>>11570they also sell .925 small silver pellets and they are well known in the market because they provide local jewelries with gold and silver. their bars are stamped with their bussiness mark and a 999 purity mark

№11579[Quote]

>>11570I fucking hate bars but these are extremely cheap

№11588[Quote]

>>11570do they stamp anything interesting into the bars? 250g one might be alright. you could see what local stores offer to sell.

№11589[Quote]

File: jej.png 📥︎ (73.84 KB, 795x362) 7871106b6786ad7e3cf155ae834f1c6318e1a30f58e23cf16516458e3572baf40ImgOps

4janny banned me already kek

№11591[Quote]

>>11589we should keep one or two of these alternative threads going. it's actually nice not having to do captcha / easier filtering / trolls less annoying

№11600[Quote]

>>11591nah, I'm ckeanning my cookies and getting the fuck outta here ASAP. fuck this raisinhole

№11607[Quote]

>>11600you are free to leave at any point

№11720[Quote]

Here’s an very good analysis of PMs market

https://youtu.be/Tw5qIuZzIlk?si=s9pb9QLK1BpvxeA7If you hold gold, silver , miners you will want to watch this ..

$5000+ gold

$100 silver

№11723[Quote]

jarvis summarize me this whole thread, do i or do i not invest all my money into gold or other bullraisin

№11782[Quote]

File: jpeg.png 📥︎ (295.01 KB, 509x574) 965953b89ec4592b79f35c22a59707dae2477259397dc470872f3de09c8349070ImgOps

I was just starting to feel comfortable here.

№11818[Quote]

>jarvis summarize me this whole thread

It is a mathematical certainty that the fiat money system will implode because money grows linearly but debt grows exponentially. When this happens everyone holding fiat will be dried cranberry (I don't like raisins) out of luck. Everyone holding gold and silver will get rich quick.

The problem is not if it happens, but when, and that is a big problem. The original crew of goldbugs from when Nixon closed the gold window waited 50 years and all died before they saw their investment ever pay off. As Keynes said, "the market can remain irrational longer than you can remain solvent." I thought the day of reckoning was here in the 2008 financial crisis, but here I am, 17 years later, still waiting.

№11819[Quote]

>>11782Same.. today we have learned that 4chan is filled with npcs. Real chads do not submit to literal troon jannies

№11861[Quote]

>>11818Waaaaaaaaaaah Jews told me silver was valuable waaaaaaaaaaaaah

№11873[Quote]

IS KILL!

everyone went back to 4chins

>i hate my fellow npc goyim!

№11910[Quote]

>>11873still a few here and on 8kun

№11911[Quote]

just doing a test

№11936[Quote]

>>11911Waaaaaaah I can't scam as many people now waaaaaaaaaaaaaah

№12292[Quote]

>>11589the amount of psyopsing is fucking wretching. I didn't realize how bad it was

№12316[Quote]

>>>11589

did everyone die?

№12328[Quote]

>>12316im still here (gunstore bro); not going back to 4chan

№12343[Quote]

File: 100oz blank.jpg 📥︎ (305.22 KB, 1920x1080) c1caead1e3e9f1395ab80144814e7b19397929eec0c7bc29383858daedcbd4a70ImgOps

I am 10-15 more business days fren. I will be able to make custom frensmark with engraved serial numbers for everyone! I have received the blanks for them today!

>10-15 days for the prototype frensmark>>12328gonna be creating custom silver! if you want some art on silver, let me know!

№12347[Quote]

Just sold an oz at the coin shop. He said that they haven’t had any buyers this week and they’re starting to run low on cash.

№12380[Quote]

Nothing dumber or poorer than a stackturd

№12394[Quote]

File: IMG_7139.jpeg 📥︎ (594.92 KB, 733x1067) 6849d9bbb1a22c954125694d0cfb173395969e647d21bfd95b614156d54990fe0ImgOps

12380

only(you) are dumber and poorer than a stack tard

>(you) only stack cowdung, filthy jeet!

№12397[Quote]

>>12343naw, im good. i stick to basic bullion and junk coins

№12409[Quote]

>>12397naw, im good. i stick to basic bitcoin and doge coins

№12440[Quote]

8kun is still going for stragglers

№12460[Quote]

peter schiff convinced me to be a fucking shiny rock retard 15 years ago instead of being a billionaire. fuck you faggots you're fucking retarded.

>>12347 №12627[Quote]

Test

№12699[Quote]

File: IMG_2854.jpeg 📥︎ (176.64 KB, 1006x1024) 01cfc7c3fcec7e7cfc7c3c7c010707870787abc4e1c2c0c780c781073c547f7c0ImgOps

№13696[Quote]

>>>13089

>>>13088

>aids lost

>Iceland won

NIGGERS

№15831[Quote]

4chuds have returned

№16330[Quote]

>>16329we are eating so good

№16332[Quote]

is it topped?

№16333[Quote]

giga thread and op

№16335[Quote]

so we just missed out on generational wealth part 19

№16336[Quote]

>>16329i bought some silver WW2 german coins, does anyone buy those in der west?

№16337[Quote]

>>16336Precious metals are precious metals so people will generally buy whatever